UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of the Securities

Exchange Act of 1934 (Amendment No. )

Filed by the Registrantx

Filed by a Party other than the Registrant o

Check the appropriate box:

o Preliminary Proxy Statement

o Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2))

x Definitive Proxy Statement

o Definitive Additional Materials

o Soliciting Material Pursuant to §240.14a-12

1st Constitution Bancorp

(Name of Registrant as Specified In Its Charter)

(Name(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment of Filing Fee (Check the appropriate box):

x No fee required.

oFee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11.

| 1. | Title of each class of securities to which transaction applies: | |

| 2. | Aggregate number of securities to which transaction applies: | |

| 3. | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (Set forth the amount on which the filing fee is calculated and state how it was determined): | |

| 4. | Proposed maximum aggregate value of transaction:: | |

| 5. | Total fee paid: | |

| ¨ | Fee paid previously with preliminary materials. |

| ¨ | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

| 1. | Amount Previously Paid: | |

| 2. | Form, Schedule or Registration Statement No.: | |

| 3. | Filing Party: | |

| 4. | Date Filed: | |

1ST CONSTITUTION BANCORP

P.O. Box 634

2650 Route 130 North

Cranbury, New Jersey 08512

NOTICE OF ANNUAL MEETING OF SHAREHOLDERS

TO BE HELD THURSDAY, MAY 30, 201927, 2021

To Our Shareholders:

The 20192021 Annual Meeting of Shareholders of 1st Constitution Bancorp will be held on Thursday, May 30, 201927, 2021 at 3:00 p.m. Eastern TimeTime. This year, we are planning to hold the Annual Meeting virtually over the Internet via a live webcast at https://web.lumiagm.com/230355398. We determined that a virtual meeting is prudent for the Forsgate Country Club, 375 Forsgate Drive, Monroe Township, New Jersey, 08831.health and well-being of our shareholders, employees and Board of Directors during the coronavirus (COVID-19) pandemic, and is necessary to comply with the governmental orders restricting travel and in-person gatherings. Unless we publicly announce a change in our plans in the manner set forth below, you will not be able to attend the Annual Meeting at a physical location.

Shareholders on the April 14, 2021 record date, or their proxy holders, are welcome to attend and participate in the live webcast of the Annual Meeting at https://web.lumiagm.com/230355398. To participate in the Annual Meeting virtually over the Internet, you must retain your 11-digit control number printed on your proxy card below your Account Number. Please carefully review the Proxy Statement for the 2021 Annual Meeting of Shareholders for further instructions on how to access the live webcast.

At the Annual Meeting, shareholders will be asked to consider and vote upon the following matters:

| 1. | The election of |

| 2. |

| The approval of the compensation of our named executive officers on an advisory (non-binding) basis; |

| The ratification of the selection of BDO USA LLP as the Company’s independent registered public accounting firm for the |

| The conduct of other business if properly raised. |

Shareholders of record at the close of business on April 10, 2019 are entitled to notice of, and to vote at, the Annual Meeting. Whether or not you contemplate attending the Annual Meeting, we suggest that you promptly execute the enclosed proxy and return it to the Company or submit your proxy on the Internet as instructed on the enclosed proxy card. You may revoke your proxy at any time prior to the exercise of the proxy by delivering to the Company a later-dated proxy or by delivering a written notice of revocation to the Company.

The Board of Directors of the Company believes that the election of the nominees and the proposals being submitted to the shareholders are in the best interest of the Company and its shareholders and urges you to vote in favor of the nominees and the proposals.

Shareholders of record at the close of business on April 14, 2021 are entitled to notice of, and to vote at, the Annual Meeting or any postponement or adjournment thereof. As always, but especially now given the uncertainties posed by the COVID-19 pandemic, we encourage you to submit your proxy promptly and prior to the Annual Meeting, whether or not you plan to attend the Annual Meeting. You may submit your proxy by completing and mailing the enclosing proxy card or over the Internet by following the instructions on the enclosed proxy. Submitting your proxy now will not prevent you from voting at the Annual Meeting. You may revoke your proxy at any time before it is exercised at the Annual Meeting by delivering to the Company a later-dated proxy card, by delivering a written notice of revocation to the Company, or by voting at the Annual Meeting.

As of the date of this letter, a state of emergency remains in effect in the State of New Jersey relating to the COVID-19 pandemic. We are permitted to hold a virtual meeting of shareholders under New Jersey law only if a state of emergency remains in effect on the date of the 2021 Annual Meeting. In the event that the state of emergency is lifted prior to the date fixed for the 2021 Annual Meeting and it is not, therefore, then legally permissible to hold a completely virtual annual meeting under New Jersey law, we will hold a “hybrid” meeting, meaning that you would be able to attend the Annual Meeting either over the Internet by participating in and listening to a live webcast of the meeting, or in-person at our Main Office. We will announce any plans to hold a meeting at a physical location in a press release and additional proxy materials that we would file with the Securities and Exchange Commission and make available on our website at http://www.1stconstitutionbank.com under “Investor Relations.” In such event, the physical component of the Annual Meeting would be held at our Main Office, located at 2650 Route 130 & Dey Road, Cranbury, New Jersey 08512. At this time, we expect that the Annual Meeting will be held solely by means of live webcast over the Internet at https://web.lumiagm.com/230355398. Please monitor our website for further information.

Important notice regarding the availability of proxy materials for the 20192021 Annual Meeting of Shareholders: The Proxy Statement for the 20192021 Annual Meeting of Shareholders and 20182020 Annual Report to Shareholders are available at: http://www.astproxyportal.com/ast/20330/.

| By Order of the Board of Directors | |

| ROBERT F. MANGANO | |

| President and Chief Executive Officer |

Cranbury, New Jersey

April 18, 201922, 2021

YOUR VOTE IS IMPORTANT

To assure your representation at the Annual Meeting, please votesubmit your proxy as promptly as possible, whether or not you plan to attend the Annual Meeting. The prompt return of proxies will save the Company the expense of further requests for proxies to ensure a quorum at the Annual Meeting. A stamped self-addressed envelope isYou may submit your proxy over the Internet or by completing and mailing the enclosed for your convenience.proxy card. You may also vote at the Annual Meeting.

1ST CONSTITUTION BANCORP

P.O. Box 634

2650 Route 130 North

Cranbury, New Jersey 08512

PROXY STATEMENT FOR ANNUAL MEETING

OF SHAREHOLDERS TO BE HELD ON MAY 30, 201927, 2021

GENERAL PROXY STATEMENT INFORMATION

This proxy statement is furnished in connection with the solicitation of proxies by the Board of Directors (the “Board of Directors” or the “Board”) of 1st Constitution Bancorp (the “Company”) for use at the 20192021 Annual Meeting of Shareholders (the “Annual Meeting”) to be held on May 30, 2019,27, 2021, at 3:00 p.m. Eastern Time,Time. This year, we are planning to conduct the Annual Meeting virtually over the Internet via live webcast at https://web.lumiagm.com/230355398 due to the Forsgate Country Club, 375 Forsgate Drive, Monroe Township,public health concerns resulting from the coronavirus (COVID-19) pandemic. Unless we publicly announce a change in our plans in the manner set forth below, you will not be able to attend the Annual Meeting at a physical location.

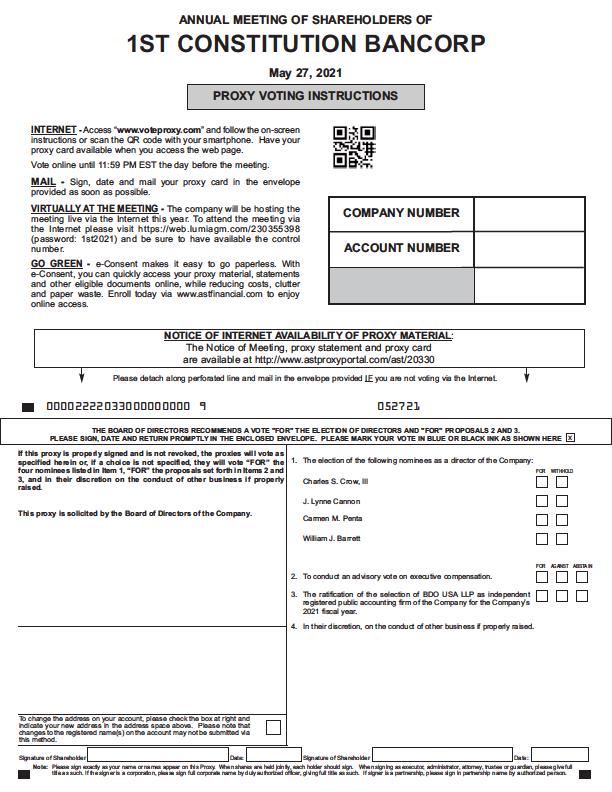

To attend and participate in the live webcast of the Annual Meeting, you must login to https://web.lumiagm.com/230355398 using the 11-digit control number printed on your proxy card below your Account Number and the meeting password, which is 1st2021. To access the Annual Meeting virtually over the Internet, you must retain your 11-digit control number printed on your proxy card. Please carefully review the section below titled “Attending the Annual Meeting” for further instructions on how to access the live webcast.

In the event that it is not legally permissible to hold a virtual annual meeting under New Jersey 08831.law on the date fixed for the 2021 Annual Meeting because a state of emergency is not then in effect in New Jersey, we will hold a “hybrid” meeting, meaning that you would be able to attend the Annual Meeting either over the Internet by participating in and listening to a live webcast of the meeting, or in-person at our Main Office. Any such change will be announced in a press release and additional proxy materials that we would file with the Securities and Exchange Commission and make available on our website at http://www.1stconstitutionbank.com under “Investor Relations.” In such event, the physical component of the Annual Meeting would be held at our Main Office, located at 2650 Route 130 & Dey Road, Cranbury, New Jersey 08512. At this time, we expect that the Annual Meeting will be held solely by means of live webcast over the Internet at https://web.lumiagm.com/230355398. Please monitor our website for further information.

The first date on which this proxy statement and the enclosed form of proxy are being sent to the shareholders of the Company is on or about April 18, 2019.22, 2021.

The Company’s principal executive office is 2650 Route 130 North, P.O. Box 634, Cranbury, New Jersey 08512. 1st Constitution Bank is a wholly-owned subsidiary of the Company and is sometimes referred to as the “Bank.”

Outstanding Securities and Voting Rights and Procedures

The Board of Directors fixed the close of business of the Company (5:00 p.m. Eastern Time) on April 10, 201914, 2021 as the record date and time for determining shareholders entitled to notice of, and to vote at, the Annual Meeting. Only shareholders of record as of that date and time will be entitled to notice of, and to vote at, the Annual Meeting.

On the record date, there were 8,628,77310,265,563 shares of common stock of the Company issued and outstanding and eligible to be voted at the Annual Meeting. Each share is entitled to one vote on each matter properly brought before the Annual Meeting. Other than Company common stock, there are no other outstanding securities of the Company entitled to vote at the Annual Meeting.

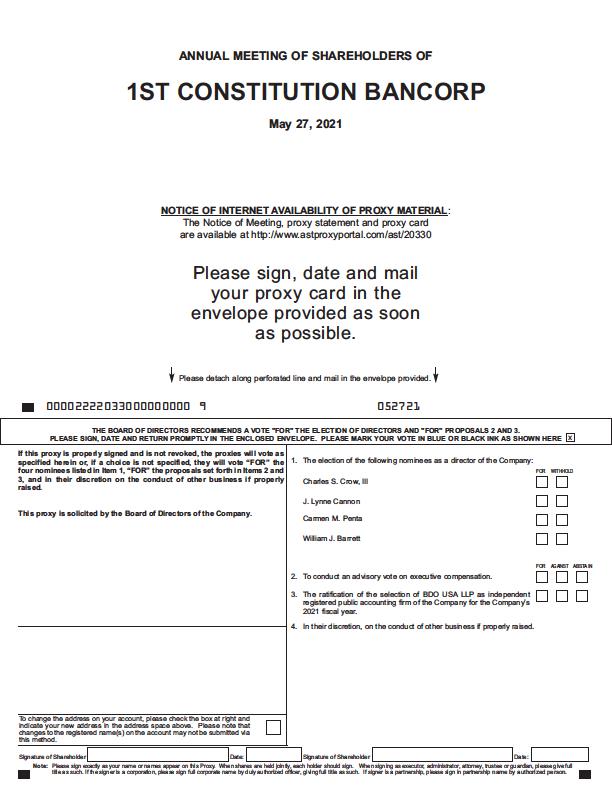

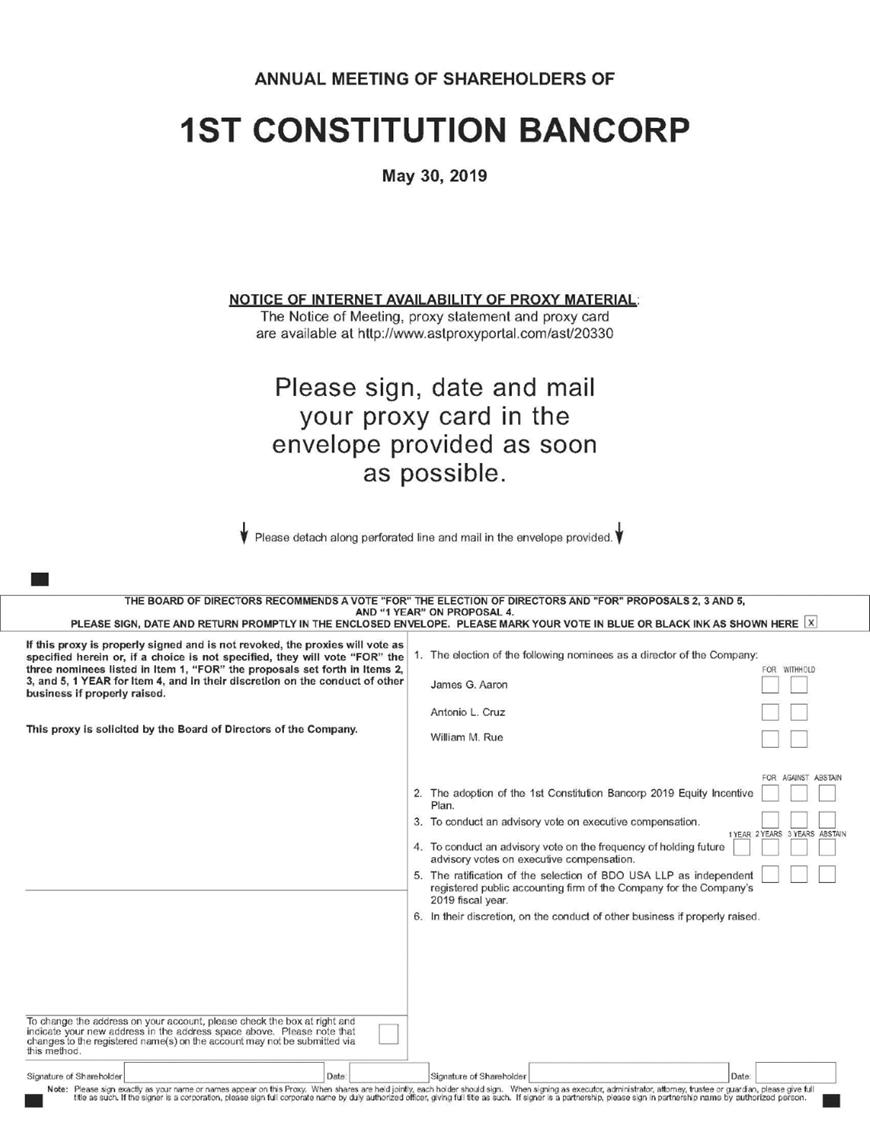

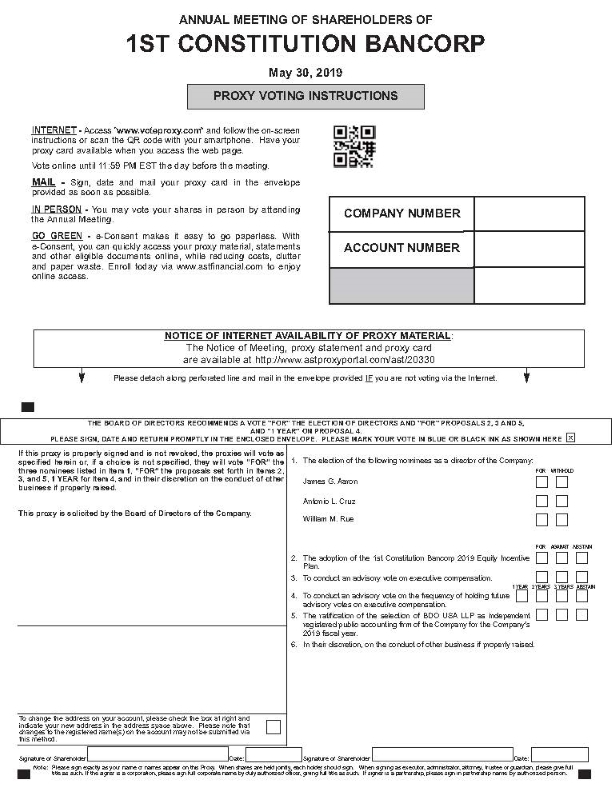

For each proxy timely submitted by a shareholder and that is not revoked, the shares represented thereby will be voted at the Annual Meeting in the manner specified on the proxy. However, if a proxy solicited by the Board of Directors does not specify how it is to be voted, it will be voted as the Board recommends, that is, (a) “FOR” the election of the threefour nominees for director named in this proxy statement; (b) “FOR” the adoption of the 1st Constitution Bancorp 2019 Equity Incentive Plan; (c) “FOR” the approval (on an advisory basis) of the compensation of our named executive officers; (d) to conduct an advisory vote on the frequency of holding future advisory votes on executive compensation every year; (e)(c) “FOR” the ratification of the selection of BDO USA LLP as the Company’s independent registered public accounting firm for the 20192021 fiscal year; and (f)(d) in connection with the conduct of other business, if properly raised, in accordance with the judgment of the person or persons named as proxies. If, for any reason, eitherany nominee for director is unable or unavailable to serve or for good cause will not serve, an event that we do not anticipate, the shares represented by the accompanying proxy will be voted for a substitute nominee designated by the Board of Directors or the size of the Board of Directors may be reduced.

ToYou may vote your proxy by mail, through the Internet or by attending and voting at the Annual Meeting. As always, but especially now given the uncertainties posed by the COVID-19 pandemic, we encourage you to submit your proxy promptly and prior to the Annual Meeting by mail or over the Internet, whether or not you plan to attend the Annual Meeting. To submit your proxy by mail, please complete your proxy card, sign your name exactly as it appears on your proxy card, date and mail your proxy card in the envelope provided as soon as possible. If you wish to vote using the Internet, you can access the web page at www.voteproxy.com and follow the on-screen instructions. Have your proxy card available when you access the web page and use the control number shown on your proxy card when prompted to do so. If you vote usingsubmit your proxy over the Internet, you must votedo so no later than 11:59 p.m. Eastern Time on May 29, 2019.26, 2021. Submitting your proxy now will not prevent you from voting at the Annual Meeting.

If any other matters are properly presented at the Annual Meeting for consideration, such as consideration of a motion to adjourn the Annual Meeting to another time or place, the persons named as proxies will have discretion to vote on those matters according to their best judgment to the same extent as the person delivering the proxy would be entitled to vote, unless the shareholder otherwise specifies in the proxy. As of the date of this proxy statement, we do not anticipate that any other matters will be raised at the Annual Meeting.

Attending the Annual Meeting

All shareholders as of the April 14, 2021 record date, or their proxy holders, are welcome to attend the Annual Meeting. We determined that a virtual meeting is prudent for the health and well-being of our shareholders, employees and Board of Directors during the COVID-19 pandemic, and is necessary to comply with the governmental orders restricting travel and in-person gatherings.

As of the date of this letter, a state of emergency remains in effect in the State of New Jersey relating to the COVID-19 pandemic. We are permitted to hold a virtual meeting of shareholders under New Jersey law only if a state of emergency remains in effect on the date of the 2021 Annual Meeting. In the event that the state of emergency is lifted prior to the date fixed for the 2021 Annual Meeting and it is not, therefore, then legally permissible to hold a completely virtual annual meeting under New Jersey law, we will hold a “hybrid” meeting, meaning that you would be able to attend the Annual Meeting either over the Internet by participating in and listening to a live webcast of the meeting, or in-person. In such event, the physical component of the Annual Meeting would be held at our Main Office, located at 2650 Route 130 & Dey Road, Cranbury, New Jersey 08512. At this time, we expect that the Annual Meeting will be held solely by means of live webcast over the Internet at https://web.lumiagm.com/230355398. Please monitor our website for further information.

Unless we publicly announce a change in our plans in a press release and additional proxy materials that we would file with the Securities and Exchange Commission and make available on our website at http://www.1stconstitutionbank.com under “Investor Relations,” you will not be able to attend the Annual Meeting at a physical location.

TO ENSURE THAT YOU ARE ABLE TO ATTEND THE ANNUAL MEETING, YOU MUST RETAIN THE 11-DIGIT CONTROL NUMBER PRINTED ON YOUR PROXY CARD.

All shareholders of record at the close of business on April 14, 2021 will be able to attend and participate in the Annual Meeting on May 27, 2021 at 3:00 p.m. via live webcast. You can access the Annual Meeting online by visiting https://web.lumiagm.com/230355398. We encourage you to access the meeting prior to the start time and to leave ample time to login. To login to the meeting as a “Shareholder,” you will need to enter your 11-digit control number, which is printed on your proxy card below your account number, and the meeting password, which is 1st2021. Otherwise, you may log into the meeting as a “Guest.” However, to have the ability to vote and ask questions during the Annual Meeting, you must login as a “Shareholder” with your control number and the meeting password.

If your shares are registered in the name of your broker, bank or other agent, you are the “beneficial owner” of those shares and those shares are considered to be held in “street name.” Beneficial owners should have received a proxy card and voting instructions with these proxy materials from the registered holder of your shares rather than directly from us. To participate in the live webcast of the Annual Meeting or to attend the Annual Meeting in person, you must obtain a valid legal proxy from your broker, bank or other agent. Follow the instructions from your broker or bank included with these proxy materials, or contact your broker or bank, to request a legal proxy form. It is expected that brokers and banks will receive a large number of requests for legal proxies, so we encourage you to contact the registered holder of your shares to obtain a legal proxy no later than 5:00 p.m., Eastern Time, on May 13, 2021.

To attend and participate in the live webcast of the Annual Meeting, you must then register in advance after obtaining a valid legal proxy from your broker, bank or other agent. To register to attend the Annual Meeting virtually, you must submit proof of your legal proxy reflecting the number of your shares along with your name and email address to our Transfer Agent, American Stock Transfer & Trust Company, LLC. Requests for registration should be directed to proxy@astfinancial.com or to facsimile number 718-765-8730. Written requests can be mailed to:

American Stock Transfer & Trust Company LLC

Attn: Proxy Tabulation Department

6201 15th Avenue

Brooklyn, NY 11219

Requests for registration must be labeled as “Legal Proxy” and be received no later than 5:00 p.m., Eastern Time, on May 13, 2021. You will receive a confirmation of your registration by email from American Stock Transfer & Trust Company, LLC after your registration materials are received.

Required Vote

The presence, in person or by proxy, of the holders of a majority of the shares entitled to vote generally is necessary to constitute a quorum at the Annual Meeting. Abstentions and broker “non-votes” are counted as present and entitled to vote for purposes of determining a quorum. A broker “non-vote” occurs when a nominee holding shares for a beneficial owner does not vote on a particular proposal because the nominee does not have discretionary power with respect to that item and has not received voting instructions from the beneficial owner.

Certain proposals, such as the ratification of the appointment of auditors, are considered “routine” matters, and brokers generally may vote on behalf of beneficial owners who have not furnished voting instructions. For “non-routine” proposals, such as the election of directors the proposal to adopt the 1st Constitution Bancorp 2019 Equity Incentive Plan,and the advisory vote to approve the compensation of our named executive officers, and the advisory vote regarding the frequency of future advisory votes on executive compensation, brokers may not vote on the proposals unless they have received voting instructions from the beneficial owner.

The affirmative vote of a plurality of the votes cast at the Annual Meeting is required to elect aeach director. An abstention or a broker non-vote will have no effect on the outcome of the vote on the election of a director. The affirmative vote of a majority of the votes cast at the Annual Meeting is required to adopt the 1st Constitution Bancorp 2019 Equity Incentive Plan, approve the compensation of our named executive officers and to ratify the selection of BDO USA LLP as the Company’s independent registered public accounting firm for the 20192021 fiscal year. For the proposal regarding the frequency of future advisory votes on executive compensation, the choice receiving the highest number of votes cast will be considered by the Board as the expected preference of shareholders. The vote for the approval of the compensation of our named executive officers and the vote for the frequency of future advisory votes on executive compensation areis on an advisory basis and areis therefore non-binding. For these last four proposals, abstentionsAbstentions and broker non-votes will not be counted as votes cast and, accordingly, will have no effect on the outcome of the vote.advisory vote on the approval of the compensation of our named executive officers and the vote on the ratification of the selection of BDO USA LLP as the Company’s independent registered public accounting firm for the 2021 fiscal year.

Election inspectors appointed for the Annual Meeting will tabulate the votes cast by proxy or in person atduring the meeting. The election inspectors will determine whether or not a quorum is present. Votes will NOT be considered cast if the shares are not voted for any reason, including an abstention indicated as such on a written proxy or ballot, if directions are given in a written proxy to withhold votes, or if the votes are withheld by a broker.

Revocability of Proxies

Any shareholder giving aYou can change or revoke your proxy hasat any time before it is exercised at the rightAnnual Meeting:

| 1. | By timely delivery of a properly executed, later-dated proxy card, |

| 2. | By timely delivery of a written revocation, |

| 3. | By submitting a new proxy via the Internet no later than 11:59 p.m. Eastern Time on May 26, 2021, or |

| 4. | By attending the Annual Meeting and either voting during the meeting or, if there is an in-person component of the Annual Meeting and you attend in-person, giving notice of revocation. |

A later-dated proxy or written revocation will be considered timely delivered if received by the Corporate Secretary of the Company (i) prior to the Annual Meeting at P.O. Box 634, 2650 Route 130 North, Cranbury, New Jersey 08512, or (ii) in the event that shareholders are permitted to attend the Annual Meeting in person in accordance with New Jersey law and to voteyou attend in person, at the Annual Meeting in person. before proxies are voted.

If your shares are held in the name of a bank, broker, or other holder of record, you must obtain a proxy executed in your favor from the holder of record a valid legal proxy executed in your favor. To register to be able to vote atattend the Annual Meeting.Meeting virtually, you must then submit proof of your legal proxy to our Transfer Agent, American Stock Transfer & Trust Company, LLC and follow the instructions set forth above under “Attending the Annual Meeting.” If you submit a proxy and then wish to change your vote, you will need to revoke the proxy that you have submitted. You can revoke your proxy at any time before it is exercised by voting in person at the Annual Meeting or by timely delivery of a properly executed, later-dated proxy or a written revocation of your proxy. A later-dated proxy or written revocation must be received before the meeting by the Corporate Secretary of the Company, at P.O. Box 634, 2650 Route 130 North, Cranbury, New Jersey 08512, or it must be delivered to the Corporate Secretary at the Annual Meeting before proxies are voted. You may also revoke your proxy by submitting a new proxy via the Internet no later than 11:59 p.m. Eastern Time on May 29, 2019.

Multiple Copies of Annual Report and Proxy Statement

When more than one holder of Company common stock shares the same address, we may deliver only one annual report and one proxy statement to that address unless we have received contrary instructions from one or more of those shareholders. Similarly, brokers and other intermediaries holding shares of Company common stock in “street name” for more than one beneficial owner with the same address may deliver only one annual report and one proxy statement to that address if they have received consent from the beneficial owners of the stock.

We will deliver promptly, upon written or oral request, a separate copy of the annual report and proxy statement to any shareholder, including a beneficial owner of stock held in “street name,” at a shared address to which a single copy of either of those documents was delivered. You may make such a request in writing to Stephen J. Gilhooly, Senior Vice President and Chief Financial Officer, 1st Constitution Bancorp, at P.O. Box 634, 2650 Route 130 North, Cranbury, New Jersey 08512, or by calling Mr. Gilhooly at (609) 655-4500. This proxy statement and the annual report are available at: http://www.astproxyportal.com/ast/20330/.

You may also contact Mr. Gilhooly at the address or telephone number above if you are a shareholder of record of the Company and you wish to receive a separate annual report or proxy statement, as applicable, in the future, or if you are currently receiving multiple copies of our annual report and proxy statement and want to request delivery of a single copy in the future. If your shares are held in “street name” and you want to increase or decrease the number of copies of our annual report and proxy statement delivered to your household in the future, you should contact the broker or other intermediary who holds the shares on your behalf.

Solicitation of Proxies

This proxy solicitation is being made by the Board.Board of Directors. The cost of the solicitation will be borne by the Company. In addition to the use of the mail, proxies may be solicited personally or by telephone, facsimile, email, or other electronic means by officers, directors and employees of the Company. We will not specially compensate those persons for such solicitation activities. Although we do not expect to do so, we may retain a proxy-soliciting firm to assist us in soliciting proxies. If so, we would pay the proxy-soliciting firm a fee and reimburse it for certain out-of-pocket expenses. Arrangements may be made with brokerage houses and other custodians, nominees and fiduciaries for forwarding solicitation materials to the beneficial owners of common stock held of record by such persons, and we will reimburse such persons for their reasonable expenses incurred in forwarding the materials.

Accelerated Filer Status

The Company satisfies the criteria to be both a “smaller reporting company” and an “accelerated filer,” and is therefore entitled to provide scaled disclosure in this proxy statement consistent with the rules of the Securities and Exchange Commission (the “SEC”) applicable to smaller reporting companies. The Company has elected to not provide scaled disclosure and to instead include in this proxy statement the disclosure required by an accelerated filer that is not also a smaller reporting company. This is consistent with the Company’s determination to continue to provide disclosure in its annual and periodic reports as an accelerated filer (that is not also a smaller reporting company) for the foreseeable future.

ITEM 1 – ELECTION OF DIRECTORS

The Company’s Board of Directors is divided into three separate classes of directors, designated as Class I, Class II and Class III. The directors in Class I are serving a three-year term that expires at the 2021 Annual Meeting; the directors in Class II are serving a three-year term that expires at the 20192022 Annual Meeting; and the directors in Class III are serving a three-year term that expires at the 20202023 Annual Meeting,Meeting; and in each case until their successors are duly elected and qualified. At each Annual Meetingannual meeting of Shareholders,shareholders, one class of directors is elected for terms of three years to succeed to those directors in the class whose terms then expire.

The Company’s certificate of incorporation requires each class of directors to consist as nearly as possible of one-third of the authorized number of directors. In the event that a nominee stands for election as a director at an annual meeting of shareholders as a result of an increase by the Board of Directors of the authorized number of directors and such nominee is to serve in a class of directors whose term is not expiring at such annual meeting of shareholders, the nominee, if elected, may stand for an initial term expiring concurrent with the expiration of the term of the directors in the class to which such nominee is elected as a director.

The director nominees for election at the 20192021 Annual Meeting are the threefour nominees for election as Class III directors: James G. Aaron, Antonio L. CruzCharles S. Crow, III, J. Lynne Cannon, Carmen M. Penta and William M. Rue, who,J. Barrett, each of whom, if elected, will each serve a three-year term expiring in 20222024 and until their successors are duly elected and qualified.

The number of nominees was determined by the Board of Directors pursuant to the Company’s by-laws. If, for any reason, any nominee for director is unable or unavailable to serve or for good cause will not serve, the shares represented by the accompanying proxy will be voted for a substitute nominee designated by the Board or the size of the Board may be reduced. The Board believes that the named nominees are available, and, if elected, will be able to serve.

DIRECTORS AND EXECUTIVE OFFICERS

The following tables set forth (i) the name, age and class of the nominees for election toas directors at the Annual Meeting, and the expiration of their term as a director if such nominees are elected, (ii) the names, ages and classes of the directors whose terms extend beyond 20192021 and the name and ageexpiration of the executive officers of the Company who do not also serve as directors of the Company, (ii)their terms, (iii) the other positions and offices presently held by such personsthe nominees and directors with the Company, if any, (iii)(iv) the period during which such persons have served on the Board of Directors, if applicable, (iv) the expiration of each director’s term as a director if such nominee is elected as a director at the 2019 Annual Meeting and (v) the principal occupations and employment of such persons during the past five years. Additional biographical information for each person follows the tables.

NOMINEES FOR ELECTION AT 20192021 ANNUAL MEETING

Name and Position with the Company, if any |

Age |

Class | Director Since | If Elected, Expiration of Term |

Principal Occupation |

| James G. Aaron | 74 | II | 2016 | 2022 | Attorney, Partner, Ansell Grimm & Aaron, Ocean Township, NJ |

| Antonio L. Cruz | 63 | II | 2016 | 2022 | Retired Attorney |

| William M. Rue, Director and Corporate Secretary | 71 | II | 1999 | 2022 | Chairman, Chas E. Rue & Son, Inc., Hamilton, New Jersey |

Set forth below is the name of, and certain biographical information regarding, the director nominees.

James G. Aaron is a senior member and shareholder in the law firm of Ansell, Grimm &Aaron, P.C., located in Ocean Township, New Jersey, and has been with such law firm since 1996. Mr. Aaron chairs the firm’s Municipal Law and Bankruptcy Practice Department. Mr. Aaron is licensed to practice law in the State of New Jersey, the United States District Court for the District of New Jersey, the United States District Court for the Eastern District of New York, and the United States Court of Claims, and is a member of the Monmouth County and New Jersey State Bar Associations. Mr. Aaron served as the municipal attorney for the City of Long Branch from 1994 to 2018. Mr. Aaron is a founder of Central Jersey Bank, N.A., a federally chartered institution, and served from 1996 until 2010 as a director and member of its executive committee. Mr. Aaron also served as a director of Colonial American Bank, and as chairman of the Board of Directors of Rumson-Fair Haven Regional Bank (prior to its merger with the Bank in February 2014). Mr. Aaron has served as a director of the Company since 2016 and as a director of the Bank since 2014, where he serves on the Loan and Investment Committee and the Nominating Committee. Mr. Aaron is currently a member of the Board of Trustees of Monmouth Medical Center, which is a part of the Saint Barnabas Medical System, where he serves on the strategic planning, medical practices, and community action committees. Mr. Aaron is also a member of the Board of Trustees of the Axelrod Performing Arts Center, the vice president and chairman of the Board of Directors of ERBA Co., Inc., and a member of the Board of Trustees of the New Jersey Jewish Home for Rehabilitation and Nursing. Additionally, Mr. Aaron served as a member of the proxy board of trustees of Hollywood Golf Club in Deal, New Jersey from 2009 to 2017, and as president of Hollywood Golf Club from 2014 to 2017. Mr. Aaron received his B.A. degree from Dickinson College in Carlisle, Pennsylvania and his J.D. from New York University School of Law.

Mr. Aaron is qualified to serve on our Board of Directors because of his education, his business skills and expertise, including service on the Board of Directors of the Bank, and his extensive legal knowledge, acquired through the years from private legal practice, as well as from his service on other boards.

Antonio L. Cruzhas served as a director of the Company since 2016 and as a director of the Bank since 2003, where he serves on the Loan and Investment Committee and the ALCO Committee. Mr. Cruz was an attorney in private practice in Perth Amboy, New Jersey. Previously, he served as a general counsel to the Perth Amboy Board of Education and has represented a number of financial institutions as a review attorney in both residential and commercial real estate law. Mr. Cruz was a member of the Hispanic Bar Association of New Jersey in which he served as a member of the Board of Trustees for many years. Additionally, Mr. Cruz served as the Commissioner of Middlesex County Utilities for 16 years and as a member of the Board of Directors of Raritan Bay Medical Center in Perth Amboy, New Jersey. Mr. Cruz received his J.D. from Northeastern University School of Law in Boston, Massachusetts, and practiced civil litigation and transactional real estate for 28 years.

Mr. Cruz is qualified to serve on our Board of Directors because of his education, his business skills and expertise, including service on the Board of Directors of the Bank, and his extensive legal knowledge, acquired through the years from private legal practice, as well as from his service on other boards.

William M. Rue has served as a director of the Company since 1999 and as a director of the Bank since 1989. Mr. Rue has served as the Corporate Secretary of the Company since 2013. Mr. Rue has served as the Chairman of Chas. E. Rue & Son, Inc., an insurance agency that has its principal office in Hamilton, New Jersey, in which role he has been since February 2013, and served previously as its President from 1985 to February 2013. Mr. Rue is a director of The Rue Foundation, a nonprofit corporation, and is a general partner at 3812 Quakerbridge Realty, LLC. Mr. Rue also served as Chairman of Rue Financial Services, Inc., a financial services provider, from 2002 to 2012. Mr. Rue has been a Chartered Property Casualty Underwriter since 1972 and an Associate in Risk Management since 1994. Mr. Rue also serves as a director for each of the following organizations: Selective Insurance Group, Inc. (a Nasdaq Global Select Market listed company), PL Services, LLC, Robert Wood Johnson University Hospital Corporation and Robert Wood Johnson University Hospital at Hamilton (where he serves as chairman of the Board of Directors). In addition, Mr. Rue is a member of the Board of Trustees of Rider University, a nonprofit private university, where he serves on the compensation committee. Mr. Rue is also a Certified Insurance Counselor.

Mr. Rue is qualified to serve on our Board of Directors and brings valuable insight to our Board of Directors as a result of his broad range of business skills and his insurance and financial literacy and expertise. Mr. Rue honed these skills and expertise during his long and successful business career, in which he served as president of an insurance agency and president of a financial services provider, as well as through his service on nonprofit boards of directors.

DIRECTORS WHOSE TERMS EXTEND BEYOND THE 2019 ANNUAL MEETING

Name and Position with the Company, if any |

Age |

Class | Director Since | Expiration of Term |

Principal Occupation |

Age |

Class | Director Since | If Elected, Expiration of Term |

Principal Occupation |

Charles S. Crow, III, Chairman of the Board | 69 | I | 1999 | 2021 | Attorney, Crow & Cushing, Princeton, New Jersey | |||||

| Charles S. Crow, III | 71 | I | 1999 | 2024 | Attorney, Crow & Cushing, Princeton, New Jersey | |||||

| J. Lynne Cannon | 72 | I | 2016 | 2021 | Chief Executive Officer, Consulting, Princeton Management Development Institute, Trenton, NJ | 74 | I | 2013 | 2024 | Chief Executive Officer, Consulting, Princeton Management Development Institute, Trenton, NJ |

| Carmen M. Penta | 74 | I | 2017 | 2021 | CPA, Partner, Addeo, Polacco & Penta, LLC, Eatontown, New Jersey | 76 | I | 2017 | 2024 | CPA, Partner, Addeo, Polacco & Penta, LLC, Eatontown, New Jersey |

| William J. Barrett | 63 | I | 2017 | 2021 | Adjunct Professor, LeMoyne College CPA, Retired Partner, Ernst & Young, LLP | 65 | I | 2017 | 2024 | Associate Dean, Madden School of Business, Le Moyne College CPA, Retired Partner, Ernst & Young, LLP |

| Edwin J. Pisani | 69 | III | 2016 | 2020 | CPA, Retired Partner, Ernst & Young, LLP | |||||

| Roy D. Tartaglia | 68 | III | 2016 | 2020 | Retired CEO | |||||

| Robert F. Mangano, President and Chief Executive Officer | 73 | III | 1999 | 2020 | President and Chief Executive Officer, 1st Constitution and 1st Constitution Bank, Cranbury, New Jersey | |||||

Set forth below are the names of, and certain biographical information regarding, the directors of the Company whose terms extend beyond the 2019 Annual Meeting.director nominees.

Charles S. Crow, III has served as the Chairman of the Board of the Company and of the Bank since March 2005. From February 2000 until May 2005, Mr. Crow served as Corporate Secretary of the Company.Company from February 2000 until May 2005 and as Chairman of the Audit Committee from May 2002 until May 2005. Mr. Crow is a partner in the law firm of Crow & Cushing in Princeton, New Jersey, which is the successor to Crow & Associates. From January 1, 1992 to November 30, 1998, Mr. Crow was a partner in the law firm of Crow & Tartanella in Somerset, New Jersey. Mr. Crow also previously served as a Chief Compliance Officer for Mount Lucas Management LP for eleven years. Mr. Crow presently serves as a director and Audit Committee member of the following funds: Parsoon Opportunity Fund Ltd.; Tenor Opportunity Master Fund, Ltd.; and Tenor Opportunity Fund, Ltd. Mr. Crow previously served as a director of the following funds: QCM OTUS Fund SPC LTD AFP SP; Blenheim Commodity Fund, Ltd; Blenheim Global Markets Fund, Ltd.; Parsoon OpportunityBlenheim Diversified Dynamic Alpha Fund Ltd.; Tenor Opportunity Master Fund, Ltd.; Tenor Opportunity Fund, Ltd.; Aria Opportunity Fund, Ltd.; and Aria Opportunity Offshore Fund, Ltd. Mr. Crow previously served as a director of the following funds: Arden-Sage Multi-Strategy Fund; Arden Sage Multi-Strategy TEI Fund; Arden Investment Series Trust (ARDNX); and Blenheim Diversified Dynamic AlphaAria Opportunity Fund, Ltd. Mr. Crow also currently serves as a member of the Board of Managers of Investor Analytics LLC.; and Aria Opportunity Offshore Fund, Ltd. In the past, Mr. Crow has served as a trustee with respect to alternative mutual funds and other registered investment advisory companies registered with the SEC under the Investment Company Act of 1940. The companies mentioned are private open-ended fund companies invested in traditional and alternative investments. Mr. Crow is also a director and member of the Compensation and Finance Committees of Centurion Ministries, Inc., a nonprofit entity that seeks to vindicate and free from prison those individuals who are factually innocent of the crimes for which they have been convicted,convicted. In addition, Mr. Crow currently serves as Chair of the Finance Committee, Vice Chair and is also a trusteeTrustee of the Antique Boat Museum in Clayton, New York, serving onhaving previously served as the Chair of the Audit and Finance Committees.Committee.

Mr. Crow is qualified to serve on our Board of Directors because of his education, his business skills and expertise, and his extensive legal knowledge, acquired over the years from private legal practice as well as through his service on other boards.

J. Lynne Cannon,has served as a director of the Company and the Bank since 2016.2013. Ms. Cannon has served as Chief Executive Officer of the Princeton Management Development Institute, a firm serving biotechnology and pharmaceutical businesses, since June 2006.2008. Prior to this, Ms. Cannon served as Global Senior Vice President of Human Resources for Novartis Biomedical Research Institute and for Bristol Myers Pharmaceutical Research. Ms. Cannon has more than 30 years of corporate and consulting experience in areas such as global strategic business and human resources management, compensation planning and strategy, succession planning, organizational development, integration and restructuring, including mergers and acquisitions and divestitures, executive search and selection and leadership development. Ms. Cannon holds graduate degrees in Organizational and Counseling Psychology from Columbia University where she has also pursued doctoral studies. Ms. Cannon has been a member of the RWJ Hamilton Board of Directors of Robert Wood Johnson University Hospital at Hamilton for more than 16 years, where she has served as the Chair and Vice Chair. Ms. Cannon is also a formercurrent member of the Arcadia University Board of Trustees, where she serves as the Chair of the Governance Committee. Ms. Cannon previously served on the governance committee, and the Mercer County Community College Foundation Board of Trustees.Trustees and served on the Robert Wood Johnson Healthcare System Board of Directors from 2008 to 2014. She was the recipient of the New Jersey Hospital Associations Trustee of the Year Award in 2014 and served on the American Hospital Association Governance Committee on American Hospital Association Board of Trustees from 2015 to 2017.

Ms. Cannon is qualified to serve on our Board of Directors because of her education, her business skills and expertise, and her extensive consulting experience, as well as her service on other boards.

Carmen M. Penta, has served as a director of the Company and the Bank since 2017. Mr. Penta, a Certified Public Accountant, has been a partner at the firm of Addeo, Polacco & Penta, LLC in Eatontown, New Jersey since 2014. From January 1998 to March 2014, Mr. Penta was a partner at EisnerAmper LLP. Prior to that, Mr. Penta was a partner in the accounting firms of Wiener, Penta & Goodman, P.C., and Amper, Politziner & Mattia, P.C., Certified Public Accountants and Consultants. Mr. Penta previously served as a director for Colonial American Bank, where he served as a member of the Colonial American Bank compensation committee and loan committee and as chairman of the audit committee. Colonial American Bank subsequently merged into Ocean First Bank. Mr. Penta also served as a member of the Board of Directors of Central Jersey Bancorp from January 26, 2006 until November 30, 2010 when Central Jersey Bancorp was merged with and into Kearny Financial Corp. Prior to the consummation of the combination of Central Jersey Bancorp and Allaire Community Bank on January 1, 2005, Mr. Penta served as a member of the Board of Directors of Monmouth Community Bancorp (the predecessor to Central Jersey Bancorp) since its inception. Mr. Penta also served as a member of the Board of Directors of Central Jersey Bank, N.A. since its inception. Mr. Penta serves on the Board of Trustees of the Brookdale Foundation. He is a former member of the Congressional Award Council, a past member of the Advisory Board of Jersey Shore Bank, past Assistant Treasurer for the Long Branch Ronald McDonald House and served on the Board of Directors of the West Long Branch Sports Association. He is also a member of the New Jersey Society of Certified Public Accountants, the American Institute of Certified Public Accountants and the Finance Committee of Big Brothers, Big Sisters. Mr. Penta attended Pennsylvania State University and received a B.S. degree from Monmouth University.

Our Corporate Governance Principles provide that individuals will not be eligible for nomination to the Board after they reach the age of 75, except that that the Board may waive this policy with respect to any such person upon the approval of a majority of the directors then in office. On the recommendation of the Nominating Committee, the Board nominated Mr. Penta as a director nominee based on his extensive experience and particular contributions to each of the Company and the Bank, which are especially relevant and necessary in order to respond to the challenges posed by the ongoing COVID-19 pandemic. In addition, waiving the retirement age requirement for Mr. Penta allows leadership continuity on the Board and on the Compensation Committee during this uncertain time. Due to Mr. Penta’s central role on the Board and its committees, we believe that his continued service on the Board is in the best interests of the Company and our shareholders.

Mr. Penta is qualified to serve on our Board of Directors because of his education, his business skills and expertise, and his extensive accounting knowledge, acquired through the years from practicing as a certified public accountant,Certified Public Accountant, as well as from his service on other boards.boards, and his familiarity with the communities that the Bank serves.

William J. Barrett, has served as a director of the Company and the Bank since 2017. Mr. Barrett, a Certified Public Accountant, retired from Ernst & Young LLP in June 2016, where he was a partner since October 1989.1989, and has served as a director of the Company and the Bank since 2017. While at Ernst & Young LLP, Mr. Barrett provided accounting, auditing and advisory services to clients across a variety of industries, including local, regional and international banks and other financial services organizations. Mr. Barrett has experience in advising on business strategy, risk management, business technology, and technology-related risks, including cybersecurity. Since August 2016, Mr. Barrett has been an adjunct professor at LeMoyneon the faculty of Le Moyne College in Syracuse, New York, and currently serves as a Professor of Practice on the accounting faculty and the Associate Dean of the Madden School of Business. He served as a member of itsLe Moyne College’s Board of Trustees and Finance Andand Audit Committee from 2008 to 2017. Additionally, Mr. Barrett currently serves on the Risk Advisory Committee of Geller and Company, a financial and professional services firm in New York. Mr. Barrett has a B.S. degree in Accounting from LeMoyneLe Moyne College and an M.B.A. in Finance from Case Western Reserve University.

Mr. Barrett is qualified to serve on our Board of Directors because of his education, his business skills and expertise, extensive accounting knowledge, and extensive experience with enterprise and technology-related risks.

DIRECTORS WHOSE TERMS EXTEND BEYOND THE 2021 ANNUAL MEETING

Name and Position with the Company, if any |

Age |

Class | Director Since | Expiration of Term |

Principal Occupation |

| James G. Aaron | 76 | II | 2014 | 2022 | Attorney, Partner, Ansell Grimm & Aaron, Ocean Township, NJ |

| Antonio L. Cruz | 65 | II | 2016 | 2022 | Retired Attorney |

| William M. Rue, Director and Corporate Secretary | 73 | II | 1999 | 2022 | Chairman, Chas E. Rue & Son, Inc., Hamilton, New Jersey |

| Raymond R. Ciccone | 63 | III | 2019 | 2023 | CPA, Managing Partner, Ciccone, Koseff & Company, CPAs, Ship Bottom, New Jersey

Forensic Accountant, Partner, The Forensic Accounting Group, Inc., Ship Bottom, New Jersey |

| Edwin J. Pisani | 71 | III | 2016 | 2023 | CPA, Retired Partner, Ernst & Young, LLP |

| Roy D. Tartaglia | 70 | III | 2016 | 2023 | Retired CEO |

Robert F. Mangano, President and Chief Executive Officer | 75 | III | 1999 | 2023 | President and Chief Executive Officer, 1st Constitution and 1st Constitution Bank, Cranbury, New Jersey |

| 11 |

Set forth below are the names of, and certain biographical information regarding, the directors whose terms extend beyond the 2021 Annual Meeting.

James G. Aaron is a senior member and shareholder in the law firm of Ansell, Grimm &Aaron, P.C., located in Ocean Township, New Jersey, and has been with such law firm since 1996. Mr. Aaron chairs the firm’s Municipal Law and Bankruptcy Practice Department. Mr. Aaron is licensed to practice law in the State of New Jersey, the United States District Court for the District of New Jersey, the United States District Court for the Eastern District of New York, and the United States Court of Claims, and is a member of the Monmouth County and New Jersey State Bar Associations. Mr. Aaron served as the municipal attorney for the City of Long Branch from 1994 to 2018. Mr. Aaron is a founder of Central Jersey Bank, N.A., a federally chartered institution, and served from 1996 until 2010 as a director and member of its executive committee. Mr. Aaron also served as a director of Colonial American Bank, and as chairman of the Board of Directors of Rumson-Fair Haven Regional Bank (prior to its merger with the Bank in February 2014). Mr. Aaron has served as a director of the Company and the Bank since 2014 and currently serves on the Loan and Investment Committee and the Nominating Committee. Mr. Aaron is also a member of the Board of Trustees of the Axelrod Performing Arts Center, the vice president and chairman of the Board of Directors of ERBA Co., Inc., and a member of the Board of Trustees of the New Jersey Jewish Home for Rehabilitation and Nursing. From 2011 to 2020, Mr. Aaron served as a member of the Board of Trustees of Monmouth Medical Center, which is a part of the Saint Barnabas Medical System, where he served on the strategic planning, medical practices, and community action committees. Additionally, Mr. Aaron served as a member of the board of trustees of Hollywood Golf Club in Deal, New Jersey from 2009 to 2017, and as president of Hollywood Golf Club from 2014 to 2017. Mr. Aaron received his B.A. degree from Dickinson College in Carlisle, Pennsylvania and his J.D. from New York University School of Law.

Mr. Aaron is qualified to serve on our Board of Directors because of his education, his business skills and expertise, including service on the Board of Directors of the Bank, and his extensive legal knowledge, acquired through the years from private legal practice, as well as from his service on other boards.

Antonio L. Cruz has served as a director of the Company since 2016 and as a director of the Bank since 2003, where he serves on the Loan and Investment Committee and the ALCO Committee. Mr. Cruz was an attorney in private practice in Perth Amboy, New Jersey. Previously, he served as a general counsel to the Perth Amboy Board of Education and has represented a number of financial institutions as a review attorney in both residential and commercial real estate law. Mr. Cruz was a member of the Hispanic Bar Association of New Jersey in which he served as a member of the Board of Trustees for many years. Additionally, Mr. Cruz served as the Commissioner of Middlesex County Utilities for 16 years and as a member of the Board of Directors of Raritan Bay Medical Center in Perth Amboy, New Jersey. Mr. Cruz received his J.D. from Northeastern University School of Law in Boston, Massachusetts, and practiced civil litigation and transactional real estate for 28 years.

Mr. Cruz is qualified to serve on our Board of Directors because of his education, his business skills and expertise, including service on the Board of Directors of the Bank, and his extensive legal knowledge, acquired through the years from private legal practice, as well as from his service on other boards.

| 12 |

William M. Rue has served as a director of the Company since 1999 and as a director of the Bank since 1989. Mr. Rue has served as the Corporate Secretary of the Company since 2013. Mr. Rue has served as the Chairman of Chas. E. Rue & Son, Inc., an insurance agency that has its principal office in Hamilton, New Jersey, in which role he has been since 2013, and served previously as its President from 1985 to February 2013. Mr. Rue is a director of The Rue Foundation, a nonprofit corporation, and is a general partner at 3812 Quakerbridge Realty, LLC. Mr. Rue also served as Chairman of Rue Financial Services, Inc., a financial services provider, from 2002 to 2012. Mr. Rue has been a Chartered Property Casualty Underwriter since 1972 and an Associate in Risk Management since 1994. Mr. Rue also serves as a member of the board of directors of board of trustees of the following organizations, as applicable: Selective Insurance Group, Inc. (a Nasdaq Global Select Market listed company), PL Services, LLC, Robert Wood Johnson University Hospital at Hamilton and Rider University, a nonprofit private university. In addition, Mr. Rue formerly served on the compensation committees of each of Robert Wood Johnson University Hospital at Hamilton and Rider University and on the board of directors of Robert Wood Johnson University Hospital Corporation. Mr. Rue is a Certified Insurance Counselor and holds a Bachelor of Science degree in Commerce from Rider University.

Mr. Rue is qualified to serve on our Board of Directors and brings valuable insight to our Board of Directors as a result of his broad range of business skills and his insurance and financial literacy and expertise. Mr. Rue honed these skills and expertise during his long and successful business career, in which he served as president of an insurance agency and president of a financial services provider, as well as through his service on nonprofit boards of directors.

Raymond R. Ciccone, a Certified Public Accountant, has served as a director of the Company and the Bank since November 2019 and has been practicing forensic accounting for over 30 years. Mr. Ciccone is the managing partner of Ciccone, Koseff & Company, Certified Public Accountants in Ship Bottom, New Jersey, which he founded in 1988, and has served as a partner and forensic accountant with The Forensic Accounting Group, Inc., which specializes in providing litigation services, due diligence review, business consulting, claim investigation, expert witness services and more to individuals and businesses, since 1995. In addition to being a Certified Public Accountant and Certified in Financial Forensics by the American Institute of Certified Public Accountants, Mr. Ciccone holds a Bachelor of Science degree in Accounting from Stockton University and Master of Science degree in Taxation from Seton Hall University. Since 2008, Mr. Ciccone served as a director and Chairman of the Audit Committee of Shore Community Bank until November 2019, when Shore Community Bank was merged with and into the Bank. Mr. Ciccone has served as a Trustee of Stockton University since 2011, and was named as Chairman of the Board of Trustee of Stockton University in 2020.

Mr. Ciccone is qualified to serve on our Board of Directors because of his education, his business skills and expertise, his extensive financial and accounting knowledge, and his familiarity with the communities that the Bank serves.

Edwin J. Pisani, a Certified Public Accountant, has served as a director of the Company since 2016, as a director of the Bank since 2014, and has over 40 years of audit and advisory experience in the financial services industry, most recently as the managing partner of Ernst & Young LLP’s Risk Management and Regulatory Consulting practice, from which he retired inon June 30, 2014. Mr. Pisani alsocurrently serves on the Board of Directors of Centurion Ministries, Inc., a nonprofit organization, and on the Boards of Directors and Audit Committees of Peak Offshore Funds, and ECOM Financial Services, formerly known as CSCC Trade.organization. Mr. Pisani has a B.S. in electrical engineering from Clarkson University, a Masters of Business Administration from Carnegie Mellon University, and a Masters of Accounting from Northwestern University.

Mr. Pisani is qualified to serve on our Board of Directors because of his education, his business skills and expertise, including his service as Chairman of the Audit Committee, and his extensive financial and accounting knowledge.knowledge, gained through years of practicing as a Certified Public Accountant in the financial services industry.

| 13 |

Roy D. Tartagliawas a co-founder and has served as a director of the Company since 2016 and the Bank since 1989, where ishe serves on the Loan and Investment Committee. Prior to his retirement in 2000, Mr. Tartaglia was the chief executive officer of RTK Group, a telecommunications company, where he oversaw mergers and acquisition activity, operations, finance and marketing functions. Mr. Tartaglia was educated at Brandywine College, and was named to Who’s Who Among Students in American Junior Colleges (1971).

Mr. Tartaglia is qualified to serve on our Board of Directors because of his education, his business skills and expertise, including service on the Board of Directors of the Bank, and his extensive management knowledge, gained through years of serving as a chief executive officer.

Robert F. Mangano is the President and Chief Executive Officer of the Company and of the Bank, in which roles he has servesserved since 1996. Prior to joining the Bank in 1996, Mr. Mangano was President and Chief Executive Officer of Urban National Bank, a community bank in northern New Jersey, for a period of three years and a Senior Vice President of another bank for one year. Prior to such time, Mr. Mangano held a senior position with Midlantic Corporation for 21 years. Mr. Mangano is Chairman of the Audit Committee of the Englewood Hospital Medical Center and serves on the Board of Trustees of Englewood Hospital Medical Center and its parent board.

Mr. Mangano is qualified to serve on our Board of Directors because of his business skills and experience, his extensive knowledge of financial and operational matters acquired from a long and illustrious career working for several banks in increasingly senior roles and leadership positions, and his deep understanding of the Company’s and the Bank’s people and products that he has acquired in over 2024 years of service.

Directors

No director of the Company, other than Messrs. Crow and Rue, is also currently a director of any other company with a class of securities registered pursuant to Section 12 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), or any company registered as an investment company under the Investment Company Act of 1940. Each of the above directors of the Company also serves as a director of the Bank.

EXECUTIVE OFFICERS WHO ARE NOT DIRECTORS

|

| |

| ||

Set forth below are the names of, and certain biographical information regarding, executive officers of the Company who do not serve as directors of the Company. Our other executive officer, Mr. Mangano, serves as the President and Chief Executive Officer and as a director of the Company.

Stephen J. Gilhooly has served as the Senior Vice President and Chief Financial Officer of the Company and the Bank and as the Treasurer of the Company since April 1, 2014. Prior to April 1, 2014, Mr. Gilhooly served as the Bank’s Senior Vice President and Chief Financial Officer. Prior to joining the Bank, Mr. Gilhooly most recently served as Senior Vice President and Treasurer of Florida Community Bank, Weston, Florida, from May 2011 to May 2013. Prior to joining Florida Community Bank, Mr. Gilhooly served as Executive Vice President and Treasurer of the banking subsidiaries of Capital Bank Financial Corporation (formerly North American Financial Holdings) (“CBF”) beginning in September 2010. Mr. Gilhooly served as Executive Vice President, Treasurer and Chief Financial Officer of TIB Financial Corp. (“TIB”), Naples, Florida, from 2006 to 2010, prior to its acquisition by CBF. Before joining TIB, Mr. Gilhooly worked for 15 years with Advest, Inc. in New York as Director in its Financial Institutions Group. Mr. Gilhooly earned a B.S. degree in Economics and a M.S. degree in Accounting from the Wharton School of the University of Pennsylvania. He is a Certified Public Accountant and a Chartered Global Management Accountant.

John T. Andreacio has served as the Executive Vice President and Chief Lending and Credit Officer of the Company since January 2018 and the Bank since September 2014. Mr. Andreacio joined 1st Constitution in March 2012 and has used his extensive management and credit knowledge to enhance the Company’s credit and lending function. Prior to joining the bank, Mr. Andreacio was President and Chief Executive Officer of Northern State Bank, a community bank in northern New Jersey, for a period of three years. Prior to that time, Mr. Andreacio held senior positons with National Penn Bank/KNBT and First Union Bank.

Recommendation

THE BOARD OF DIRECTORS UNANIMOUSLY RECOMMENDS A VOTE “FOR” THE DIRECTOR NOMINEES.

ITEM 2 – THE ADOPTION OF THE 1ST CONSTITUTION BANCORP 2019 EQUITY INCENTIVE PLAN

General

The Board has approved for submission to the Company’s shareholders the 1st Constitution Bancorp 2019 Equity Incentive Plan (the “Plan”). The Plan provides that the Committee (as defined below) may grant participants stock options (“Options”), restricted stock, restricted stock units (“RSUs”), stock appreciation rights (“SARs”) or such other awards as the Committee may determine. The number of shares of common stock to be reserved and available for awards under the Plan will be 400,000 plus any remaining available shares under the 2013 Equity Incentive Plan (the “2013 Plan”). As of the close of business on April 10, 2019, the value of the shares of common stock to be reserved and available for awards under the Plan was $7,352,000 based on the closing price of the common stock of the Company on such date of $18.38 per share) .

If the Company’s shareholders approve the Plan, (i) the Committee shall discontinue granting awards under the 2013 Plan; and (ii) none of the shares that may be returned to the 2013 Plan in accordance with its provisions will be added to the number of shares available for grant under the Plan.

If the Company’s shareholders fail to approve the Plan, the Company intends to continue to utilize the shares remaining available for future grants under the 2013 Plan in accordance with the terms of that plan.

Description of the Plan

The following is a general description of the material features of the Plan. This description is qualified in its entirety by reference to the full text of the Plan, a copy of which is attached asAppendix A.

Purpose. The purpose of the Plan is to assist the Company in attracting, retaining, motivating and rewarding employees and other persons who provide substantial services to the Company or its subsidiaries or affiliates, to provide for equitable and competitive compensation opportunities, to recognize individual contributions, to reward achievement of Company goals, and to promote the creation of long-term value for shareholders by closely aligning the interests of participants with those of shareholders.

Types of Awards. The Plan provides that the Company may grant participants Options, restricted stock, RSUs, SARs or such other awards as the Committee may determine. Options awarded under the Plan may either be options that qualify as incentive stock options (“ISOs”) under Section 422 of the Internal Revenue Code of 1986, as amended (the “Code”), or options that do not, or cease to, qualify as ISOs under the Code (“nonqualified stock options” or “NQSOs”).

Eligibility. Awards may be granted under the Plan to employees of the Company or any subsidiary or affiliate, including any executive officer or employee director of the Company, a consultant or other person who provides substantial services to the Company or a subsidiary or affiliate, and any person who has been offered employment by the Company or a subsidiary or affiliate, provided that such prospective employee may not receive any payment or exercise any right relating to an award until such person has commenced employment with the Company or a subsidiary or affiliate. Non-employee directors shall not be eligible to participate in the Plan. As of December 31, 2018, the Company had three employees, and the Bank had 194 employees.

Administration. The Plan will be administered by a committee of two or more directors selected by the Board, who are “non-employee directors” within the meaning of Rule 16b-3 of the Exchange Act, and “independent” within the meaning of Nasdaq Listing Rules applicable to the Company (the “Committee”). The Committee shall have full and final authority to select participants, to grant awards, to determine the type and number of awards, to establish the terms, conditions, restrictions and other provisions of awards (including, but not limited to, provisions intended to complement the Company’s insider trading policy), to cancel or suspend awards, to prescribe documents evidencing or setting terms of awards, amendments thereto, and rules and regulations for the administration of the Plan and amendments thereto, to construe and interpret the Plan and award documents and correct defects, supply omissions or reconcile inconsistencies therein, and to make all other decisions and determinations as the Committee may deem necessary or advisable for the administration of the Plan. Decisions of the Committee shall be final, conclusive, and binding upon all persons interested in the Plan.

Shares Available; Adjustments. A total of 400,000 shares (plus any remaining available shares under the 2013 Plan) have been reserved for issuance under the Plan and, if the Plan is approved at the Annual Meeting, will be available for delivery in connection with awards under the Plan. Shares delivered under the Plan shall be authorized and unissued shares, or treasury shares, or partly out of each, as shall be determined by the Board. If any awards under the Plan, in whole or in part, are forfeited, terminated, expire unexercised, are settled in cash in lieu of shares, are exchanged for other awards or are released from a reserve for failure to meet the maximum payout, the shares that were subject to or reserved for such awards shall again be available for awards under the Plan to the extent of such forfeiture, termination, expiration, settlement in cash, or exchange of such awards or to the extent the shares were so released from a reserve. However, shares tendered to satisfy an exercise price, shares withheld to satisfy tax withholding, and shares not delivered under stock appreciation right awards shall not be available for subsequent reissuance. With respect to shares reserved and available for ISOs, the rules described in this section shall apply only to the extent consistent with applicable regulations relating to ISOs under the Code.

In the event that the Company changes the number of issued common shares without new consideration to the Company (including, but not limited to, through any large, special and non-recurring dividend or other distribution, recapitalization, forward or reverse split, stock dividend, reorganization, merger, or other similar corporate transaction or event affects the common stock such that an adjustment is determined by the Committee to be appropriate under the Plan), then the Committee shall, in such manner as it may deem equitable, adjust any or all of (i) the aggregate number of shares that may be issued under the Plan, (ii) the number and kind of shares which may be delivered in connection with awards granted thereafter, (iii) the annual per person award limitations described below, (iv) the number of shares available for grant as ISOs (v) the number and kind of shares subject to or deliverable in respect of outstanding awards, and (vi) the exercise or purchase price relating to any outstanding Option, SAR, or other award under the Plan. The Committee intends to make this adjustment for future annual stock dividends issued to holders of the Company’s common stock, if any.

Per-Person Award Limitations. Participants are limited in any year to awards under the Plan relating to no more than 100,000 shares per type of award (that is, (i) Options, (ii) restricted stock and RSUs, (iii) SARs, and (iv) other awards).

Vesting. The minimum stated vesting period for awards covering at least 95% of the shares reserved under the Plan shall be one (1) year.

Terms of Stock Options. The exercise price per share purchasable under either an ISO or a NQSO shall not be less than the fair market value of a share of stock on the date of grant of the Option. The Committee shall determine the term of each Option, provided, that no Option may have a term in excess of ten years from the date of grant. The Committee shall determine the time or times at which or the circumstances under which an Option may be exercised in whole or in part, the methods by which such exercise price may be paid or deemed to be paid and the form of such payment, including, without limitation, cash, stock, other awards or awards granted under other plans of the Company or any subsidiary or affiliate, or other property, and the methods by or forms in which stock will be delivered or deemed to be delivered in satisfaction of Options. Unless otherwise set forth in an Option award agreement, a participant’s Options shall become fully vested upon termination of employment as a result of his or her death or Disability (as defined in the Plan).

Terms of Restricted Stock and RSUs. Restricted stock is stock which is subject to certain restrictions and to a risk of forfeiture. An RSU is a contract right under which the participant is entitled to receive a share of stock if certain restrictions and conditions are satisfied. The Committee will determine the period over which the restricted stock and RSUs will vest, and will impose such restrictions on transferability, risk of forfeiture and other restrictions as the Committee may in its discretion determine. Time-based restricted stock and RSUs shall automatically vest upon a participant’s termination of employment as a result of death or Disability, unless otherwise provided in the applicable award agreements. Delivery of stock (or cash equivalent) in connection with the lapse of restrictions with respect to RSUs shall occur at such times as the Committee shall determine. Unless restricted by the Committee, a participant granted restricted stock shall have all of the rights of a shareholder, including the right to vote the restricted stock and the right to receive dividends thereon. In the case of RSUs, no shares of stock shall be issued at the time an award is made, and the Committee shall determine whether such RSU award will be credited with dividend equivalents equal to dividends paid on shares of the Company’s common stock during the applicable restricted period and, if so, when and in what form such dividend equivalents will be paid. In no event shall any dividends or dividend equivalents be paid unless and until the award associated with such dividend or dividend equivalent has vested.

Terms of SARs. The Committee may grant SARs in tandem with an Option or on a freestanding basis. Upon exercise of an SAR, the participant will be entitled to payment of the positive difference in value between the exercise price and the fair market value of a share of stock on the date of exercise. The exercise price will be at least equal to fair market value of a share of stock as of the date of grant. The Committee shall determine the term of each SAR, provided that no SAR may have a term in excess of ten years from the date of grant. The Committee shall determine the time or times at which, or the circumstances under which, an SAR may be exercised in whole or in part, the methods by which the SAR may be settled, including, without limitation, cash or stock, and all other terms and conditions of the SAR. Unless otherwise set forth in an SAR award agreement, a participant’s SARs shall become fully vested upon termination of employment as a result of death or Disability.

Other Awards. The Committee is authorized to grant such other awards to participants as the Committee in its discretion may determine (an “Other Award”); provided, however, such other awards shall comply with applicable federal and state securities laws, the Code and Nasdaq Listing Rules applicable to the Company. The Committee shall determine the terms, conditions, restrictions and other provisions of such other awards.

Forfeiture Provisions. In addition to any forfeiture or reimbursement conditions the Committee may impose upon an award (including pursuant to any right or obligation that the Company may have regarding the clawback of “incentive-based compensation” under Section 10D of the Exchange Act), a participant may be required to forfeit an award, or reimburse the Company for the value of a prior award, by virtue of the requirement of Section 304 of the Sarbanes-Oxley Act of 2002 (or by virtue of any other applicable statutory or regulatory requirement or Company policy), but only to the extent that such forfeiture or reimbursement is required by such statutory or regulatory provision or Company policy.

Compliance with Legal and Other Requirements;New Plan Benefits. No shares, or payments of other benefits under any award will be issued until completion of such registration or qualification of such shares or other required action under any federal or state law, rule or regulation, listing or other required action with respect to any stock exchange or automated quotation system upon which the shares are listed or quoted, or compliance with any other obligation of the Company, as the Committee may consider appropriate. Awards are subject to the discretion of the Board and therefore amounts which would have been received by the eligible participants if the Plan had been in place for fiscal year 2018, or such amounts which may be granted in the future, are not determinable. Awards granted to our named executive officers during fiscal year 2018 are set forth in the Outstanding Equity Awards at 2018 Fiscal Year End table below. As of April 2, 2019, the Committee has granted in 2019 restricted stock awards in the amount of 8,000 shares, 10,300 performance-based restricted stock units and Options to acquire 2,500 shares under the 2013 Plan.

Amendment, Modification and Termination of the Plan. The Board may amend, suspend or terminate the Plan or the Committee’s authority to grant awards under the Plan without the consent of shareholders or participants. Any amendment to the Plan shall be submitted to the Company’s shareholders for approval not later than the earliest annual meeting for which the record date is after the date of such Board action if such shareholder approval is required by any federal or state law or regulation or the rules of any stock exchange or automated quotation system on which the stock may then be listed or quoted. Without the consent of an affected participant, no Board action may materially and adversely affect the rights of such participant under any outstanding award, unless such action is deemed necessary in order to achieve compliance with tax or securities laws or regulations. Subject to the anti-dilution adjustment provisions discussed underShares Available; Adjustments above, the Committee may not, without the approval of the Company’s shareholders (i) amend the terms of an outstanding Option, SAR or Other Award to reduce the exercise price of such outstanding Option, SAR or Other Award; (ii) cancel an outstanding Option, SAR or other award in exchange for Option, SAR or Other Award with an exercise price that is less than the exercise price of the original Option, SAR or Other Award; or (iii) cancel an outstanding Option, SAR or Other Award with an exercise price above the current stock price in exchange for cash or other securities.

Change in Control. Unless otherwise provided by the Committee in the award document or subject to other applicable restrictions, the treatment of an award in the event of a Change in Control (as defined in the Plan) will depend on whether or not the award is assumed or substituted by the surviving entity.

With respect to awards assumed by a surviving entity or otherwise equitably converted or substituted in connection with a Change in Control, if within two (2) years after the effective date of the Change in Control, a Participant’s employment is terminated and such termination is a Qualifying Termination (as defined in the Plan), then:

With respect to awards which are not assumed by a surviving entity or otherwise equitably converted or substituted in connection with a Change in Control:

Notwithstanding anything to the contrary within Section 8 of the Plan, with respect to an RSU or Other Award, if a Change in Control occurs which is not a change in control as determined by Section 409A of the Code, then such a Change in Control will not cause an acceleration of the payment date of an award, except to the extent that Section 409A would permit such an acceleration.